- The Angle

- Posts

- Commoditize Your Complement: Meta AI Edition

Commoditize Your Complement: Meta AI Edition

The Angle Issue #222

Commoditize your complement: Meta AI edition

David Peterson

Now, if you’re a student of the startup world, you’ve probably heard the phrase “commoditize your complement” thrown about when discussing technology business strategy. Joel Spolsky wrote a famous blog post about the idea as it relates to open source, though Carl Shapiro and Hal Varian’s book Information Rules: A Strategic Guide to the Network Economy is where I first came across the idea. However, Shapiro and Varian’s book is a bit too dense for a friendly, neighborhood newsletter like ours, so let me quote Spolsky instead:

"Every product in the marketplace has substitutes and complements. A substitute is another product you might buy if the first product is too expensive. Chicken is a substitute for beef. If you’re a chicken farmer and the price of beef goes up, the people will want more chicken, and you will sell more.

…A complement is a product that you usually buy together with another product. Gas and cars are complements. Computer hardware is a classic complement of computer operating systems…

All else being equal, demand for a product increases when the prices of its complements decrease."

Spolsky unearths a bunch of relevant examples from technology history as well. For example, he tells the story of how IBM designed the architecture for the PC using off-the-shelf parts (instead of custom parts) and then documented everything in the IBM-PC Technical Reference Manual to create a standard and commoditize the add-in market (which is a complement to the PC market).

This is all ancient history now. What’s the point? Well, this exact dynamic has continued up the stack and is relevant to this day:

Microsoft commoditized the PC market by licensing their operating system to all those PC manufacturers that IBM enabled. As PCs themselves became commodity, the demand for the operating system skyrocketed.

Then the operating system market became competitive, with Apple (macOS) and Google (Chrome OS) joining the fray. Microsoft stayed in the lead for a long time until the internet (and, in particular, the browser) commoditized the operating system itself. Who cares about the OS when you’re just hanging out in the browser?

Mobile is an entirely different story. Smartphones were a brand new platform opportunity. Apple got an early lead by taking a highly integrated approach (owning both the hardware platform and the software that ran on it) which enabled them to build a far superior user experience. In response, Google released the Android mobile operating system for free, creating a competing worldwide standard in the process to commoditize the mobile device/OS layer entirely and drive more people online. (More people online means more people searching which means more ad revenue for Google.)

On desktop, the internet used to be just links and information, but in the 2010s, the internet became all about applications. And cloud applications themselves commoditized much of the technology underneath, largely due to improvements like WebGL, which enabled desktop-like application experiences in the browser. (You can see how this played out with companies like Figma eating Adobe’s lunch.)

But mobile has been stuck. There’s been no OS commoditization like on desktop, because mobile applications aren’t accessed via the browser, they’re accessed via apps. Those apps have to be approved by the app store, which is governed by the owner of the OS. And who owns the mobile OS? Apple (iOS) and Google (Android).

All of which leads me to Meta’s announcement on Thursday of the launch of their latest open source large language model: Llama3.

Llama3 8B and 70B are both available and surprisingly, stunningly, good…beating out both open source and paid models of similar sizes. Llama3 400B is still training, but early indications suggest it will likely be GPT4 level or better.

Why is Meta investing so heavily in these models and then just open sourcing them?

It’s useful to remember that not only is Meta an application company, but at this point, Meta is more or less exclusively a mobile application company.

And that’s why, according to Mark Zuckerberg (in this conversation with Dwarkesh Patel), Meta’s throwing billions of dollars at generative AI models it plans to release for free. Because Apple and Google won the mobile ecosystem and act as gatekeepers, and he doesn’t want that same dynamic to play out with AI.

That is part of it, I’m sure. (And who would deny Zuck the opportunity to stick it to Apple). But I’m not so sure I believe him.

From my vantage point, generative AI isn’t a new platform opportunity like mobile. And I don’t think Zuck believes it is, either. If it was, he’d be investing billions of dollars to own that platform himself (just like he did with the Oculus and the “metaverse”).

But generative AI is the perfect complement to Meta’s family of apps…apps that are built around connecting with other people on the one hand, and creating content, following content creators, and sharing that content with the world on the other.

What Zuck has realized is that Meta’s products will be much more enjoyable (and more valuable) with generative AI sprinkled throughout. And he doesn’t need to own the model for that to be true. So if he can drive down the cost of inference, Meta benefits big. And he’d rather be the one that sets the global standard, because, as we’ve learned, that’s what market leaders do.

The last thing I’ll note is that Meta’s open source strategy is perhaps even more disruptive than any of us yet realize. How many companies focused on generative AI security, safety and evaluation will go up in smoke now? What is the business model for a company like Mistral moving forward? OpenAI may still own a vibrant customer-facing product moving forward (“chatGPT” does seem to have staying power), but who will pay for their models?

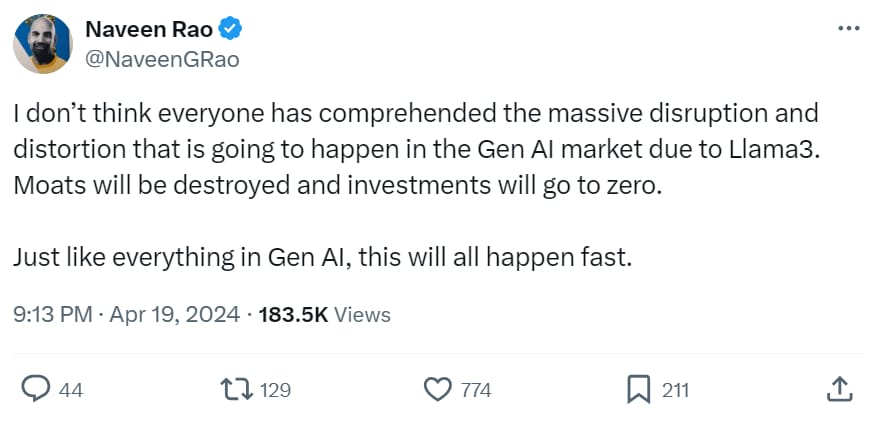

As Naveen Rao, VP Generative AI at Databricks, tweeted soon after Llama3 was released:

David

FROM THE BLOG

Revenue Durability in the LLM World

Everything about LLMs seems to make revenue durability more challenging than ever.

A Robotic Future for Retail Grocery, Finally.

Why we invested in Finally.

A Digital Fabric for Maritime Trade

Why we invested in Portchain.

Three Keys to the Kingdom

The sometimes-competing and sometimes-aligned goals that early-stage founders must manage.

EUROPE AND ISRAEL FUNDING NEWS

Denmark / Fintech. Flatpay raised $47M, led by Dawn Capital, to continue the growth of its SMB-focused payment solution (POS, card terminal etc.) platform.

Germany / Fintech. Finmid raised €35M, led by Blossom Capital, to drive the continued development of its financial infrastructure (namely embedded financing capabilities) platform.

Germany / Fintech. Pliant raised $19M, led by PayPal Ventures, to expand its B2B credit card platform to the US.

UK / Fintech. Wagestream raised £17M, led by British Patient Capital, to extend runway for its wage-financing platform.

UK / SpaceTech. Orbex raised £16.7M, largely from insiders like the Scottish National Investment Bank, to gear up for the upcoming launch of its first rocket powered by renewable biofuel.

France / eCommerce. Veesual raised $7.5M, led by AXA Ventures Partners, for its AI-powered virtual try-on platform.

France / SpaceTech. Dark raised $5.2M, led by Eurazeo, for its ultra-flexible rocket platform that can do everything from satellite launches to pick-up space debris.

WORTH READING

ENTERPRISE/TECH NEWS

Where did SaaS profits go? Benn Stancil digs into this surprising but extremely important question. He begins with a powerful observation: “According to Jamin Ball’s figures, the average public software-as-a-service company has gross margins of 74 percent—it only costs them a dollar to manufacture something they can sell for four dollars. This is almost double the gross margin of the average company in the S&P 500, which is around 40 to 45 percent. However, the average operating margin for an S&P 500 company is positive 15 percent, compared negative 11 percent for the average SaaS company. Despite their high gross margins, SaaS companies don’t just make less than other public companies; most of them actually lose money.” Let’s skip right to the crux of Benn’s answer: “The uncomfortable answer, I think, is that software margins—and especially SaaS margins—are an accounting fiction…software development costs are COGS. Not literally; not according to the accountants. But in practice, if you can only sell SaaS software—and retain customers—by promising a steady stream of new releases, how are the expenses associated with developing those releases functionally any different than the money you spend on servers and support agents?...It’s probably time for software businesses, and SaaS businesses in particular, to drop that identity. We should build a new theory that acknowledges that software can’t be sold unless it’s continually being redesigned and updated, that software margins aren’t actually that high, and that step three is mostly a theoretical fantasy. We should kick out the outdated cornerstone, and build a new business plan with the pieces that are still useful.”

Maybe SaaS is dead? Jason Lemkin of SaaStr digs into the “feeling of malaise hanging over the SaaS world today.” He traces the problem to a lengthy slowdown in SaaS buying and multiple compression. “The downturns in 2008, 2016 even were harder. They felt like the end of the world. But they were shorter. Even the SaaS downturn of 2008-2009, when the global economy almost shut down, was shorter. SaaS actually came back faster than we realized in retrospect then. This downturn that started right around Oct-Nov 2021 is now in Year 3. Some of us didn’t feel it until later, but that’s when it started. And that’s a long time ago now. That’s the source of the real malaise I think. That and the fact that revenue multiples are still not just below the peak of the Go-Go Times of 2021, but about as low as they’ve been since 2017. Roughly speaking, the lower revenue multiples … the harder everything just is in SaaS.” The entire post is worth reading because Lemkin goes into some survival strategies which make a lot of sense. Here’s one of them: “Close every customer. For the past 18-24 months, we’ve been leaning in hard on the existing base. Raising prices multiple times. Forcing upgrades. Etc. Etc. Maybe that worked for you in the short term, maybe it didn’t. But it doesn’t work forever, and it doesn’t make customers happier. The best way to ensure a brighter future is literally to close every single prospect you get that you can make happy. Does that mean a cheaper edition? Maybe do it. Does that mean making your free edition … more free? Do it. Does that mean letting folks downgrade instead of leave? Do it. Does that mean not forcing everyone to go through a qualification process if they don’t want to? Then don’t make them. Go long here. What’s most important is that you increase your new customer count 20%-50% a year. That’s your future.”

The rise of luxury software. Scott Belsky anticipates an era of “luxury software” in which software is often chosen for its aesthetic/artistic merit or brand value rather than for any specific capabilities, may of which will be commoditized. “Where will we see luxury software transform markets? Already, in the consumer productivity space, we’re starting to see “luxury” email clients, calendars, browsers, and search engines emerge. While all of these capabilities are freely accessible to consumers and rather commoditized, companies like Superhuman for email, Cron (now Notion) for calendars, Arc for web browsing, and Perplexity for search have emerged as higher-end alternatives that also carry some degree of status for their users. Since we’re discussing luxury goods, it is worth wondering what exactly is the subconscious social flex associated with these brands?”

The state of vectorDBs. Techcrunch reviewed the current status of the booming vectorDB market, a group of companies that has attracted a ton of venture dollars and contains within it a fair number of European players including Qdrant from Germany, Vespa from Norway, and Weaviate from the Netherlands. Despite the justified excitement, it's not entirely clear that this category has legs as a standalone. ““Dedicated databases tend to be fully focused on specific use cases and hence can design their architecture for performance on the tasks needed, as well as user experience, compared to general-purpose databases, which need to fit it in the current design,” Peter Zaitsev, founder of database support and services company Percona, explained to TechCrunch. While specialized databases might excel at one thing to the exclusion of others, this is why we’re starting to see database incumbents such as Elastic, Redis, OpenSearch, Cassandra, Oracle, and MongoDB adding vector database search smarts to the mix, as are cloud service providers like Microsoft’s Azure, Amazon’s AWS, and Cloudflare.”

LLMs keep getting bigger and more powerful. The Economist looks at the state of LLMs today and peers into their future. “Albert Gu, a computer scientist at Carnegie Mellon University, nevertheless thinks the transformers’ time may soon be up. Scaling up their context windows is highly computationally inefficient: as the input doubles, the amount of computation required to process it quadruples. Alongside Tri Dao of Princeton University, Dr Gu has come up with an alternative architecture called Mamba. If, by analogy, a transformer reads all of a book’s pages at once, Mamba reads them sequentially, updating its worldview as it progresses. This is not only more efficient, but also more closely approximates the way human comprehension works. LLMs also need help getting better at reasoning and planning. Andrej Karpathy, a researcher formerly at Openai, explained in a recent talk that current llms are only capable of “system 1” thinking. In humans, this is the automatic mode of thought involved in snap decisions. In contrast, “system 2” thinking is slower, more conscious and involves iteration. For ai systems, that may require algorithms capable of something called search—an ability to outline and examine many different courses of action before selecting the best one. This would be similar in spirit to how game-playing ai models can choose the best moves after exploring several options.”

HOW TO STARTUP

Is your TAM big enough? VentureCrew shared a piece by Rob Go on six strategies for convicing a VC that your market opportunity is big enough to support a venture return. While hacking a pitch is not necessarily such a great strategy, the framework is quite useful in terms of thinking about opportunity size in general. The distinction, for example, between top-down for existing markets and bottom-up for new markets is intriguing. Rob’s discussion of “scope expansion” is particularly helpful. “This is some version of “Today we are doing X, but that just puts us in a great position to do Y, which is obviously huge.” There are a couple of flavours of this. The first is the bank shot. This is where X is actually not the foundation of a great sustainable business but could be a gateway to more. A lot of VCs have a hard time with bank shots unless you are already demonstrating some really remarkable traction. Usually, the right approach here is to focus on growth and scale as quickly and efficiently as possible when accomplishing X, and make most of your money doing Y down the road when you have a network effect, customer lock-in, or can provide a valuable service that no one else could provide without your scale. The second version of this is when X is actually pretty decent. Maybe it won’t be “the next Facebook,” but it could certainly get you to a pretty attractive place. Usually, this works well when the underlying business is profitable and decently large without being too capital-intensive, which gives you more freedom to pursue the bigger opportunity as a next step. This allows an investor to say to themselves, “I could reasonably get a 5–10X on the core business, and there is some small probability that this could actually be a 20X or more.” Usually, this means that the company is in a market that has decent prospects for future funding or M&A, such that if the business hits a double but not a home run, it still could be a good outcome.”

Six career principles. These principals by David Kellogg of Balderton are not - strictly speaking - startup advice, but they are such good advice in general, that we’re going to share them anyway. David offers six general pieces of career advice that are relevant for just about anyone. Here’s the quick summary: “(1) Answer the effing question (ATFQ). Not answering questions wastes time, frustrates coworkers and executives, and can stall your career. (2) Know your in-memory analytics. Know what numbers you should know in your sleep, why, and then know them. Executives will often use this as a basic form of competency testing. (3) Understand the three fundamental layers of management (manager, director, VP). Learn how to think like the next level. It’s not that easy. (4) Write actionable emails. Write messages that are written to be responded to, quickly and tersely. Have empathy for the recipient. (5) Be a simplifier. The fastest way to get stuck as a project manager (or equivalent) is to be seen as someone who complexifies simple things instead of simplifying complex things. (6) Follow the three golden rules of feedack. It has to honest. It has to be timely. And, the tough one, it has to be kind.”

HOW TO VENTURE

From FOAK to NOAK. David Yeh discusses how financing challenges change when a company moves from “first of a kind” (FOAK) to “nth of a kind” (NOAK). “If FOAK crosses the “Valley of Death”, NOAK bridges projects to repeatable bankability. Nth-of-a-kind projects that are de-risked at scale are rewarded with access to deep pools of comparatively cheap capital. This may be from institutional infrastructure investors like Antin, Macquarie, GIC, Generate, and Brookfield’s Energy Transition Fund, as well as, ideally, global asset managers like Carlyle and mega-pensions like CPP Investments. By NOAK, it becomes possible to raise debt (and other credit vehicles) from conservative project finance banks, like MUFG or Santander. By this stage the gates of non-dilutive capital have opened — key to the FOAK-to-NOAK transition. Projects are no longer built with equity, but ideally ~80% debt. Finally, growth doesn't come at the price of dilution. A NOAK investor speaks a different language than the world of VC: Rather than looking at the growth potential of the company, they’re looking for proof that projects are delivered and operate as intended. Consistently. Again and again. Until underwriting becomes beautifully boring.”

PORTFOLIO NEWS

Lunar.dev's CEO, Eyal Solomon, joined SE Radio’s Kanchan Shringi for a discussion on tooling for API consumption management.

Portchain announced a global partnership with Ocean Network Express (ONE). Leveraging Portchain Connect, ONE can implement Just-In-Time arrivals to save fuel and emissions.

PORTFOLIO JOBS

Groundcover

Legal Operations Manager (Tel Aviv)

Reply