- The Angle

- Posts

- Europe/Israel Enterprise/Tech Weekly

Europe/Israel Enterprise/Tech Weekly

Issue #49: For the week ended January 28, 2019

Europe/Israel Enterprise/Tech Weekly

Issue #49: For the week ended January 28, 2019

Over the weekly, I released the 2018 Angular Ventures Europe and Israel Venture Investment report, an 83-page slide deck covering VC investment trends across the region. Click the images below to check out the report — and please consider sharing the report with your network.

Some key takeaways:

It was another record year for European & Israeli Venture Activity, with over $25.1B invested compared to $20.3B in 2017. The UK led with $6B, Israel was second with $4.5B, and Germany and France were a virtual tie for third with $3.6B and $3.5B respectively. Sweden and Spain were virtually tied for a distant fourth with $1.25B and $1.24B, respectively.

The total number of rounds was down slightly — average round sizes are way up.

Israel leads in terms of total corporate VC activity and in terms of US VC activity — but is dangerously concentrated on cybersecurity.

Much of Europe (the UK and Germany in particular) appear heavily concentrated on fintech.

Estonia was first in terms of VC dollars / total GDP.

A shift towards enterprise is underway in several markets.

US VC participation rates in EU/IL rounds edged downward in 2018.

Check out the full report here. As you might imagine — this is a ton of work to do — so if you like it — please show a little twitter love.

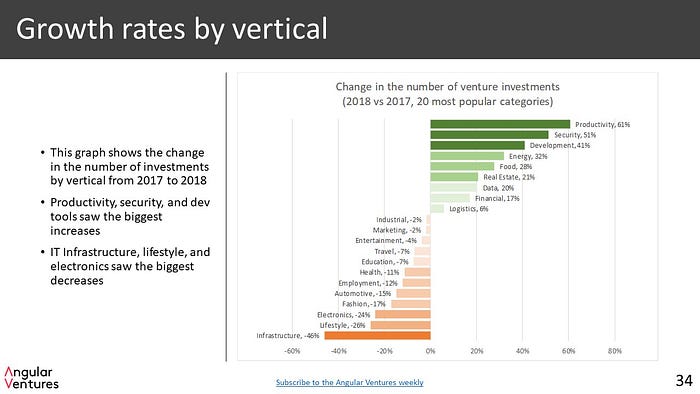

My favorite graph is the one that shows the annual change in focus by vertical:

If you are building an enterprise tech startup in Europe or Israel,

please let me know… Now let’s get to the news.

From the blog

2015–2018 Europe & Israel Venture Data: $25.1B of 2018 VC investment summarized in 83 slides. Show some twitter love by clicking here.

A Security Layer for the Physical World: Why we invested in DUST Identity

Angular’s first investment: Why we invested in Aquant.io

Europe/Israel Enterprise/Tech

UK/Security. Email security company Tessian prepares to take a $40M investment from Sequoia.

Netherlands/Real Estate Analysis. Geophy raised $33M for a property valuation platform.

Norway/Biometrics. Zwipe raised $14M for biometrics.

Denmark/Log Analytics. Humio raised $9M for log analysis.

Finland/Databases. MariaDB launches a managed service that fuses operational and analytical databases.

Quel dommage. French regulators fine Google EUR 50M for failure to define customer consent adequately. The smart money is saying watch Ireland — where many of these GDPR court cases and regulatory actions against American companies are likely to take place. I’m of two minds. There’s no doubt in my mind that European regulators are over-zealously cracking down on American tech giants — and over-zealous regulators are never a good thing. On the other hand, European regulators are ahead of the curve in struggling with some of the data privacy concerns that are going to be a global issue. The US will follow — and some US states (including California) are already moving in this direction. One interesting view I’ve heard is that American regulators and legislators — prompted by their European counterparts — have the opportunity to come up with more sensible regulations. Here’s hoping.

AI ATC at LHR. London’s Heathrow airport starts experimenting with AI-based air traffic control.

The Chinese bear hug. Legendary Israeli VC and politician Erel Margalit warns Israeli cyber companies against getting too close to China or other autocratic regimes.

Israel as sandbox. How Israel became a sandbox for non-Israeli consumer startups to test their offerings before going global. “When e-scooter company Bird decided to expand outside of the U.S. in 2018, only two cities were on its initial list: Paris and Tel Aviv. Half a year before Bird’s mid-August launch in Israel, the company’s vice president Patrick Studener visited Tel Aviv. Sunny weather, a young population, and a knack for innovation made Tel Aviv a perfect fit for the mobility company, Studener figured. “I thought, wow, it’s got to work.””

Most innovative countries. Bloomberg released its 2019 innovation index. First place went to South Korea, followed by Germany, Finland, Switzerland, and Israel. The US was ranked 8th. The UK was 18th.

Q: How do you say “unicorn” in German? A: “Einhorn.” A list of German startups worth over $1B.

Eurovision. Israel gears up to host Eurovision 2019. If you are a true European, this is very important. If you are Israel — this is probably even more important. If you are American — just move on. Nothing about this makes any sense at all. (For the all-time greatest Eurovision performance ever: click here.)

Worth reading

Enterprise/Tech News

A new open source giant. Confluent raised $125M on a $2.5B valuation. The company is basically the commercialization of Apache Kafka, an open source stream processing software platform originally developed by LinkedIn in 2011.

Amazon’s Cloud King. The Information with a brilliant profile of Andy Jassy, CEO of AWS. “While it is common for companies in the tech industry to cooperate in some areas with competitors, Amazon’s seemingly boundless ambitions have sharpened concerns that working with AWS could mean enriching a company that might one day become a mortal threat. Some privately worry that Amazon could gain useful insights into their businesses if it holds their data in AWS. AWS has denied that it does any such thing.”

Quantum in real life? How Airbus is experimenting with real-world applications of quantum computing.

Hard times at McAfee. The security giant has laid off 200 employees(4% of staff) as it struggles to regain its leadership in a super competitive industry. “Selling software to protect devices from viruses and other cybersecurity threats is “the most competitive segment of the security market,” said Andrew Nowinski, senior research analyst at Piper Jaffray. And, he said, while the security market is growing overall, many chief information officers are shifting their spending to other areas, like single-sign-on products that allow users to enter one password and gain access to many applications, which aren’t McAfee’s strengths. McAfee’s share of the security software market fell to 5.1% in 2017 from 8.7% in 2013, Gartner estimates.”

Where is AI headed? MIT researchers look at over 16,000 papers to figure out the future of AI: “Through our analysis, we found three major trends: a shift toward machine learning during the late 1990s and early 2000s, a rise in the popularity of neural networks beginning in the early 2010s, and growth in reinforcement learning in the past few years.” As for what’s next, the answers are a bit foggier.

AI vs. Humans. New research suggests AI will disrupt 36M American jobs by 2030, with another 52M jobs at further risk.

US vs. Huawei. How the US war against Huawei has spread to Europe. “The [Trump] administration is warning allies that the next six months are critical. Countries are beginning to auction off radio spectrum for new, 5G cellphone networks and decide on multibillion-dollar contracts to build the underlying switching systems. This past week, the Federal Communications Commission announced that it had concluded its first high-band 5G spectrum auction. The Chinese government sees this moment as its chance to wire the world — especially European, Asian and African nations that find themselves increasingly beholden to Chinese economic power.” I suspect this is not just a “Trump administration phenomenon,” but something that will persist even after Trump is gone. For more on Huawei’s connections to intelligence gathering, check out this backgrounder from Wired.

The decline of newspapers. An amazing graph that captures the speed of the destruction of this industry.

How to Startup

How much ARR can a CSM manage? Tomasz Tunguz shares some data on the topic.

GTM partnering for enterprise tech. Martin Casado from A16Z on how to manage this optimally. “So if you’re in b2b with direct sales, hyper focus on PMF, sell your product as a founder, build a direct team first (senior sales reps over high level VPs), and then once you get to repeatability, entertain GTM partnerships. Until then, meet partners in the market.”

“Let me tell you something you already know” — Rocky Balboa 1976: A detailed account of how one entrepreneur saved over $1M by starting his company in Philadelphia. The same holds true for locations around the world. For founders starting out outside the US (especially outside the Bay Area), cost savings in the early phases are a significant strategic advantage. Getting the timing and strategy for US market entry is critical.

How to Venture

Sharpshooting. Semil Shah discussed seed fund investment strategies:”Seed is what I know. While I get to observe multistage investing in my role as a Venture Partner with Lightspeed, seed is where I spend my time. In seed, assuming fund sizes are kept in check, can afford a manager many shots on goal. The extreme of this is a “spray and pray” approach. The other end of the spectrum are seed funds which concentrate positions upfront and behave more like Series A and B pickers. There is no “right” approach.” As he writes, there is no right answer. Angular’s approach is to be a sharpshooter: relatively few bets, very high conviction, 100% shots on goal, and as high a hit rate as possible.

I am the founder of Angular Ventures, a specialist early-stage enterprise tech VC firm based in London and Tel Aviv. Angular backs companies born in Europe or Israel with the ambition to define a category and achieve global leadership, usually by starting with the US market. You can follow me onTwitter and Medium. If you are running an early-stage start-up in the enterprise space anywhere in Europe or Israel, I’d love to hear from you to see if Angular can help. You can find a list of past and current portfolio companies here.

Yours,

Gil Dibner

Reply